Asset Management

REDEFINING VALUES, CREATING TRUST

We understand the unique challenges that come with managing wealth. We strive to serve as a trusted partner of individuals and families, providing customized wealth management solutions based on a thorough understanding of each clients’ finances, objectives and values. We aim to protect and enhance your wealth by considering these factors:

Security

Planning

Investment

Diversification

Relationships

OUR CUSTODIANS

RBC Investor & Treasury Services named #1 Custodian for the eighth consecutive year.

Global Investor Global Custody Survey 2018.

National Bank Independent Network (NBIN) is a division of NBF Inc., which is an indirect, wholly owned subsidary of National Bank of Canada.

Olympia Trust has become over the years a leader in custodial services registered exempt market securities.

OUR CORE VALUES

Independence

Independence enables us to evaluate any investment opinion freely, and to use entirely objective research in developing our recommendations.

Integrity

Excellence

Respect

Respect is reflected by an investment process that is realistic, transparent and focused on our clients’ wealth management objectives.

ALTERNATIVE INVESTMENTS

Alternative investments are not intended to replace an entire portfolio, but rather to add diversification by including strategies less dependent on positive stock and bond market performance.

A growing demand

For many investors, alternative investments are relatively new. However, many individuals are already exposed to these types of assets yet have not realized it. For example, alternatives through capital investments in private businesses, purchases of real estate, and even through participation in pension plans such as the Canada Pension Plan Investments (according to its 2021 Annual Report, more than 48% of its net investible assets are invested in alternatives).

Historically, alternative investments have mostly been used by institutional investors, endowments and ultra-high net worth investors due to high minimum requirements, inherent complexities, low liquidity and limitations in regulation. But as alternatives become more widely available and popular, they are making their way into the mainstream.

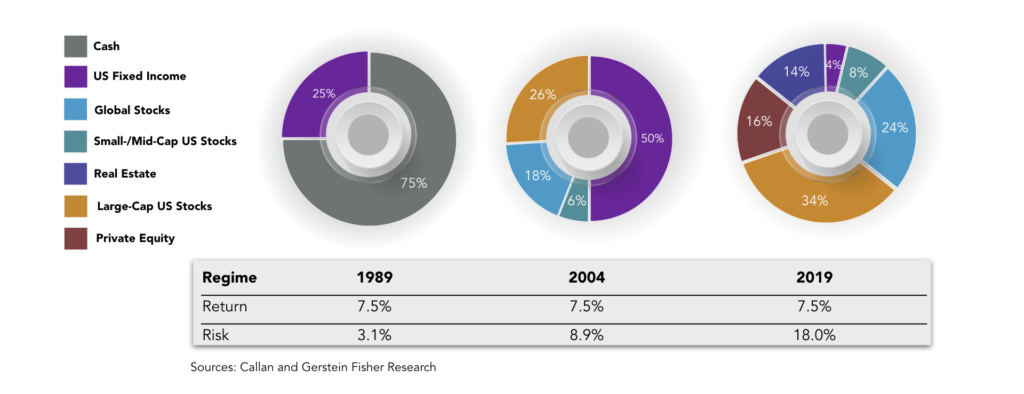

The Retirement Investment Challenge study by “The Gerstein Fisher Team (2019)”

Investors need to take far more risk than 15 or 30 years ago to earn the same expected return of 7.5%